Federal Reserve

-

Fatal Decadence

Podcast: Download

Darrell talks about how we let Western Civilization fail because we individually and collectively failed to comprehend its virtues and stopped thinking about the divine image of God in each individual.

Transcription / Notes

-

A Journal of the Plague Year – A Terrible Choice

Podcast: Download

Darrell Castle talks about the war on the virus, how the world’s economies have shut down, the United States has intentionally put itself into negative GDP to fight it, and now faces a terrible choice.

Transcription / Notes:

-

How The Republic Became A Monarchy – Part 2

Podcast: Download

Darrell Castle continues his discussion of the income tax and the Federal Reserve.

-

How The Republic Became a Monarchy – Part 1

Podcast: Download

Darrell Castle talks about how the U. S. power structure was fundamentally altered to allow the end of our republican form of government. This is a review of a timeless topic from the “best of” archives while Darrell continues to recover from knee surgery.

Transcription / Notes

-

The Great Crash Plus Ninety Years

Podcast: Download

Darrell Castle discusses the Great Crash on its 90th anniversary in the hope that by examining the past we can learn something about the present and the future.

Transcription / Notes

-

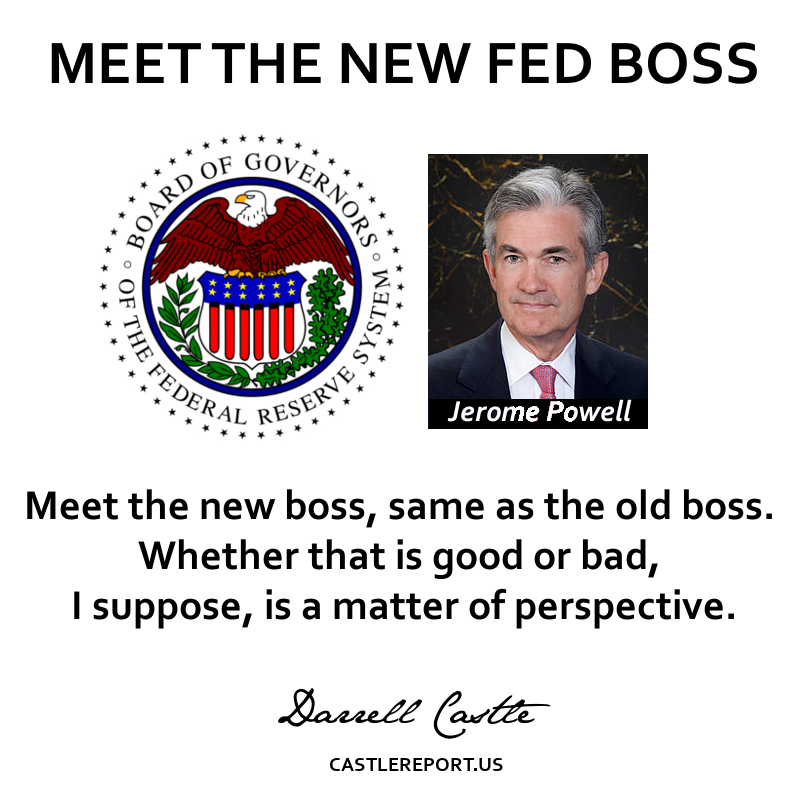

Meet The FED’s New Boss

Podcast: Download

Darrell Castle talks about the new Federal Reserve Chairman recently appointed by President Trump.

Transcript / Notes

-

A Case For Ending The Federal Reserve

Podcast: Download

Darrell Castle explains his reasons why the United States should end the Federal Reserve’s control of the United States’ monetary system.

-

End the Fed

I have said that if I were elected, two of the first things on my agenda would be getting the United States out of the United Nations and ending the Federal Reserve. Why do I believe so strongly that the United States should end the Federal Reserve’s control of the monetary system?

I have said that if I were elected, two of the first things on my agenda would be getting the United States out of the United Nations and ending the Federal Reserve. Why do I believe so strongly that the United States should end the Federal Reserve’s control of the monetary system?First a little background. Currently any money that is created comes into existence as debt. The United States government goes into more debt when it gets dollars from the Federal Reserve or individual Americans go into more debt when they take out loans from individual banks.

If the U.S. decides it needs more dollars it can’t just start up the printing press and print them. It has to ask the Federal Reserve for the dollars. The Federal Reserve as you hopefully know, is a privately owned central bank that has been granted authority by the U.S. congress to issue dollars, set interest rates, and “run the United States economy.” All U.S. government debt is created through the Federal Reserve System.

-

State Banks

Part of the solution to America’s Economic Problems?

Virtually every problem that we face in America can be traced back to our current monetary system, set up in 1913 with the passage of the 16th Amendment and the creation of the Federal Reserve System. It has been over 100 years of chaos, war, depression, recession, and boom/bust economics. That is because the United States Congress surrendered its constitutionally-mandated authority over America’s monetary system to a cartel of bankers, who formed a central bank called the Federal Reserve (the FED). This bank is the central bank of the U.S., and since the US dollar is the world’s reserve currency, it is has become the de-facto central bank of the world.

Virtually every problem that we face in America can be traced back to our current monetary system, set up in 1913 with the passage of the 16th Amendment and the creation of the Federal Reserve System. It has been over 100 years of chaos, war, depression, recession, and boom/bust economics. That is because the United States Congress surrendered its constitutionally-mandated authority over America’s monetary system to a cartel of bankers, who formed a central bank called the Federal Reserve (the FED). This bank is the central bank of the U.S., and since the US dollar is the world’s reserve currency, it is has become the de-facto central bank of the world.CENTRAL BANKS

Central banks exist to create money and loan it to governments at interest. They also set banking rules within the banking industry and with the manipulation of those rules they can control a nation’s economic success or failure. The point is that the FED creates money from nothing on its computers and loans it out at interest.

-

Where Is The Depression?

Podcast: Download

Darrell Castle talks about the U.S. economy and looks at today compared to the 1930’s Great Depression.